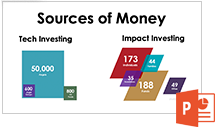

It takes a whole startup ecosystem to create successful companies, and that includes startups (new projects from existing organizations), Angels, venture capital funds, families and foundations.

The Foundation Accelerator invites foundations and families to a 10-week training for program officers and others to learn how to blend investments with grants, using existing capital to catalyze more impact.

Language

Nonprofits and for-profits are too often divided by a common language.

Nonprofits and for-profits are too often divided by a common language. We’ll fix that.

Knowledge

Debt, equity, revenue-share, recoverable grants and all the terms and conditions of investments.

Debt, equity, revenue-share, recoverable grants and all the terms and conditions of investments.

Hands-On

We’ll collectively make investments, to give you hands-on, real experience being an impact investor.

We’ll collectively make investments, to give you hands-on, real experience being an impact investor.

In short, this is Impact Investing 101 and 201 for Foundations, teaching everything from the common terminology used by for-profit investment funds through: debt, equity, revenue-based structures and recoverable grants, the due diligence process, portfolio management, the realities from the company side of the table, and more.

Topics

Participants will learn a wide variety of topics related to investing, including:

- Impact Investing vs. Philanthropy

- The Realities of Startups

- Blended, Catalytic, Impact Capital

- Philanthropists and Investors: Divided by a Common Language

- Integrated, Full-Spectrum, Blended Investing

- Debt, Equity, and Recoverable Grants

- Revenue-based Investing

- Dissecting a Pitch Deck

- Managing a Portfolio of Investments

- Transactions vs. Relationships

Free Workshops

No new workshops are scheduled.

Slides and Video Recordings

Time, Terms, Conditions, and Questions

Contact us for terms and conditions, and to answer your questions.